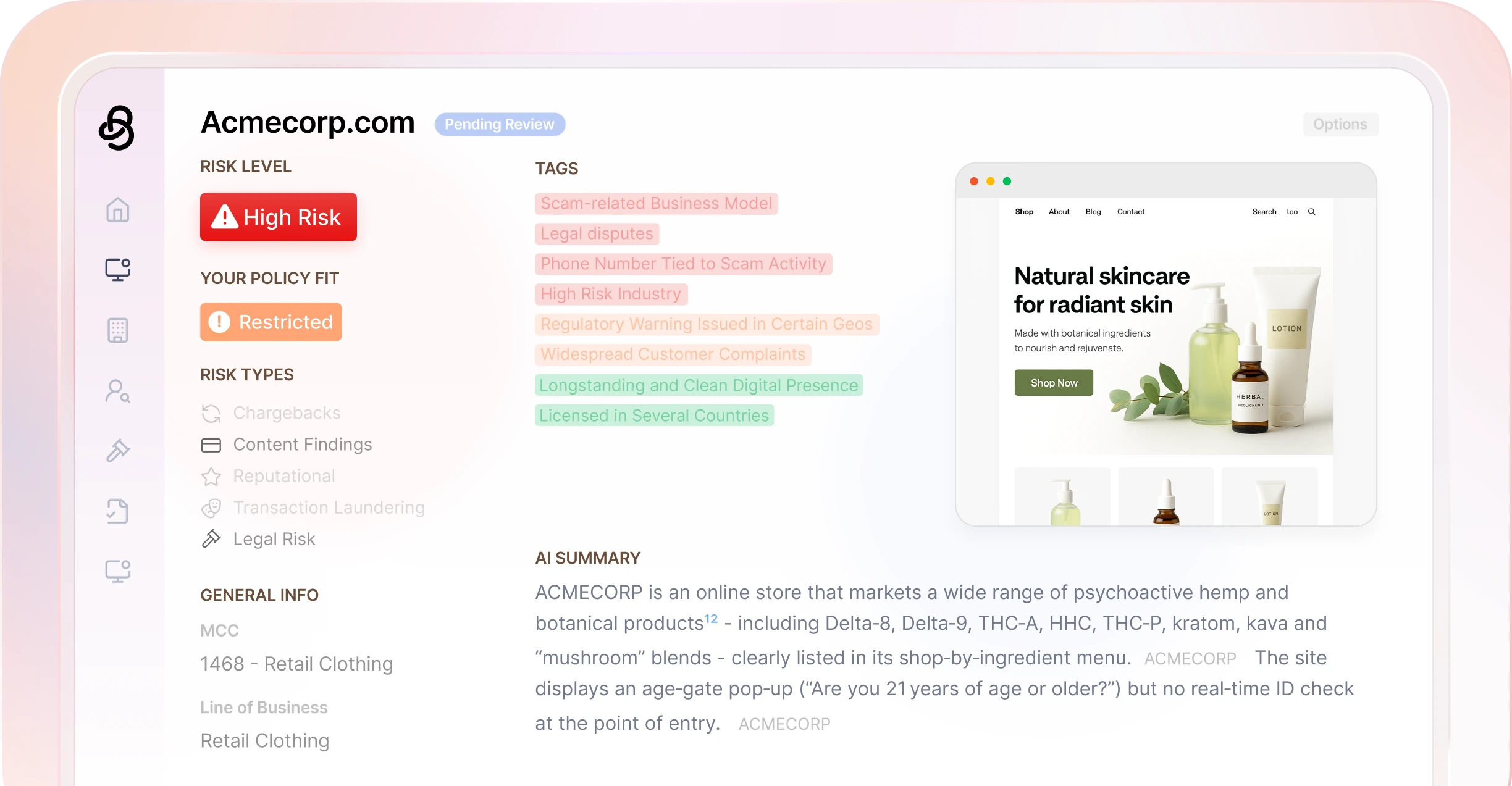

Your expertise-driven intuition is now scalable

90%

Fewer false positives cases

Contextual AI analysis dramatically improves accuracy compared to legacy rule-based systems.

2x-3x

Faster merchant onboarding

Dynamic risk profiling and automation accelerate approval timelines without compromising compliance.

50-70%

Reduction in manual work

Freeing the team to focus on high value cases by reducing manual reviews at scale.

.webp)

.webp)

.webp)

.webp)

.png)

.webp)

.webp)

.webp)