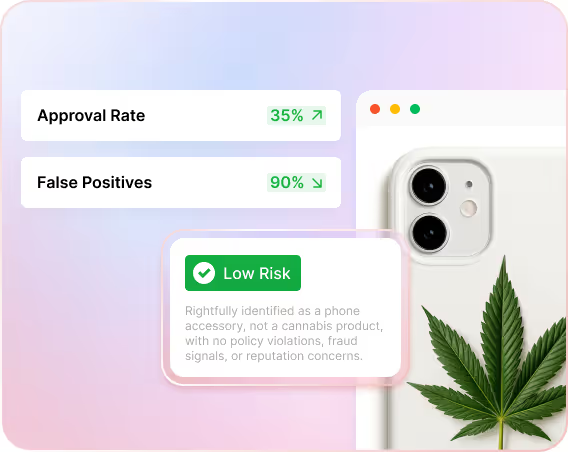

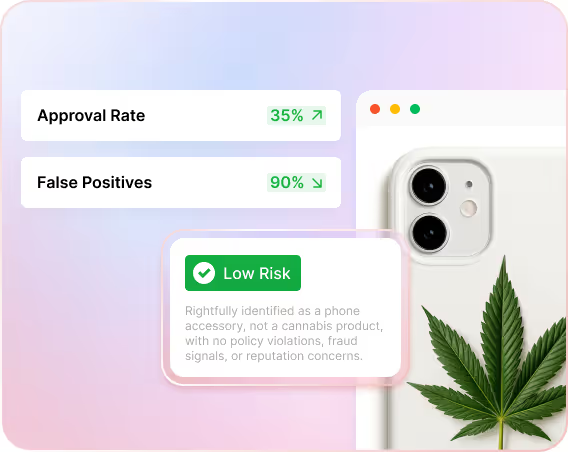

Reduce false positives by 90%

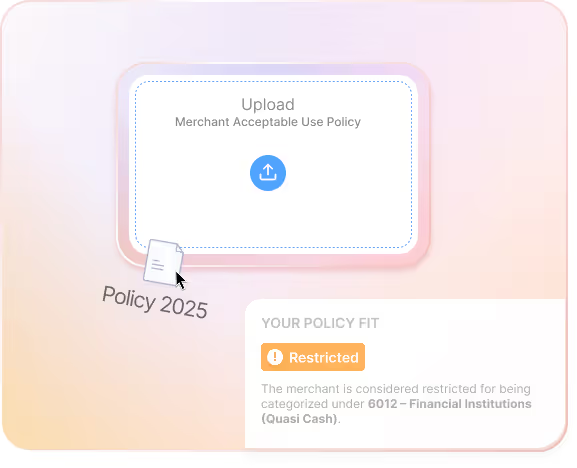

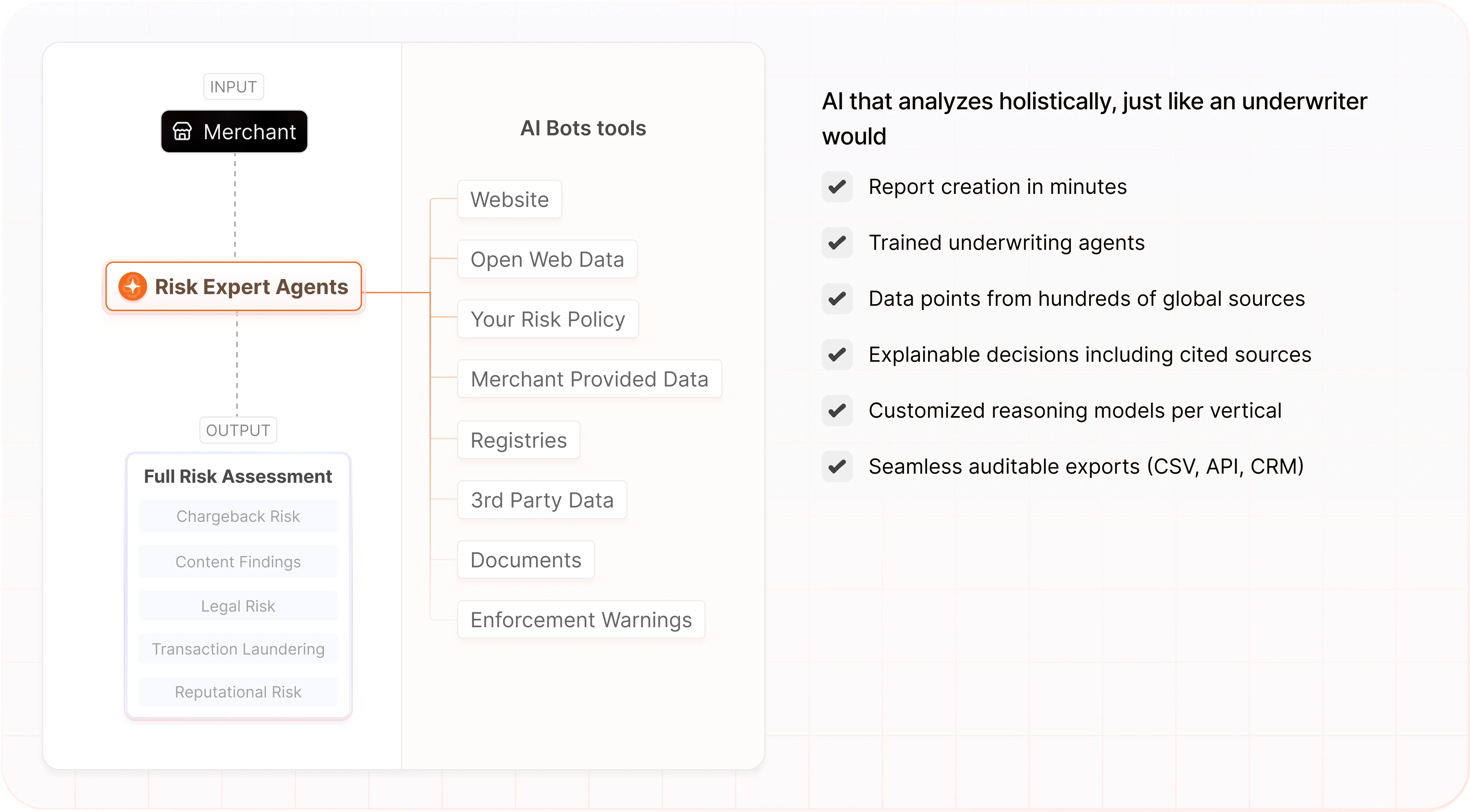

AI agents under your command let you take merchant underwriting risk management to a whole new level. Instantly identify risk, reduce manual work and turn fragmented data into confident decisions.

.png)

.webp)

Get 5 free digital footprint reports and explore how we can help protect your business from risk